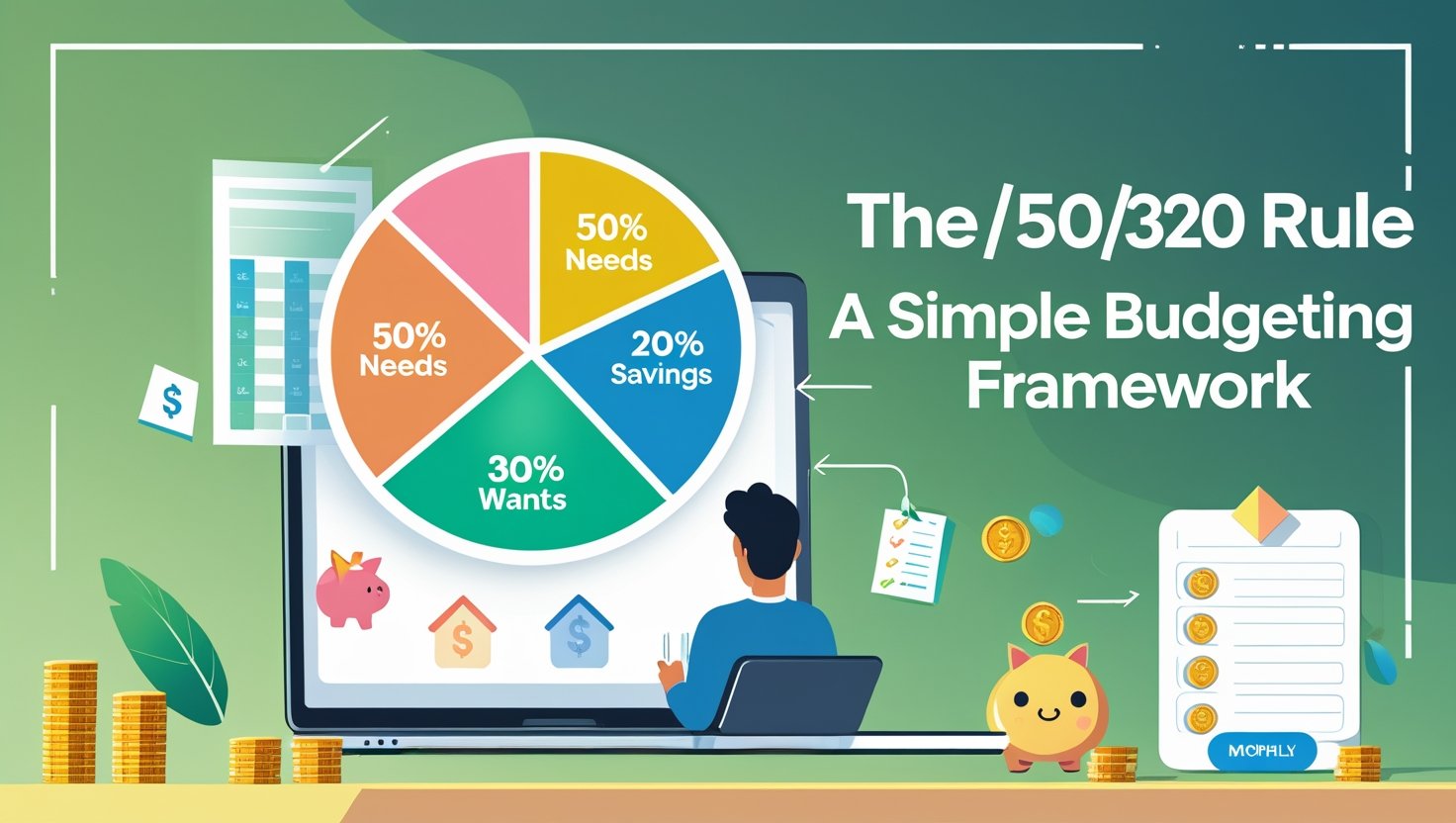

When we talk about managing our money, first of all, it is important to understand that everyone calculates their income in some way or the other. But often people face the problem that they do not follow any proper framework or system, due to which they either spend too much or do not focus on savings. The 50/30/20 rule is popular because it is very simple and practical, and is also easy for beginners. In this, a person divides his total income into three parts: The first part is 50% which is kept for essential things like rent, electricity, water, groceries, etc. The second part is 30% which is kept for those things that are related to a person’s luxury or happiness, like going to restaurants, watching movies, or shopping. The third part is the most important, which is 20% and this person uses it in saving or paying off his loans.

The biggest feature of this rule is that the person keeps their expenses under control every month, and when you do regular savings, money is ready for emergencies or retirement. Every person, whether he has a small income or a big one, can bring balance to his financial life by following this rule.

Breaking Down the ‘Needs’ Category (50%):

When we talk about keeping 50% of income for essential things, it means that you should adjust your house expenses, electricity, water, gas, groceries, basic transport, and all those bills that are essential for living on this amount. These are those things which cannot be avoided. But often people make the mistake they mixing their needs and wants. For example, if you need a new car while the old one is running, then it is not a need but a want. Therefore, first of all, it is important to define your needs clearly so that your 50% budget is utilized properly. If you see that your house rent or utility bills are high, you must think about how to reduce them. Maybe you can buy a smaller house or adopt ways to save electricity.

This way, you will save money for other categories as well. Many people’s monthly bills go so high that they have nothing left for savings or luxury. This 50% rule is designed so that a person can fulfill their basic needs comfortably but still save money. When you strictly follow this, you know how much to spend on what and when to stop. This habit makes you financially strong in the long run and also keeps you away from stress. Therefore, understanding the needs and keeping them within limits is the first step to success in budgeting.

Understanding ‘Wants’ and Lifestyle Expenses (30%):

When we talk about ‘wants’ in the 50/30/20 rule, it means those things that make your life better and enjoyable, but can be lived without. This 30% part gives you a chance to enjoy something for yourself from your hard-earned money. It includes dining out, movies, shopping, vacations, branded clothes, gadgets, and such things, which are not necessary but are important for a person’s happiness and relaxation. Often, people mix needs and wants, due to which budgeting fails. Therefore, it is important that you decide in a very clear manner what you want and what you need. If you spend all your money every month on needs, then your life becomes boring, and then, sometimes in frustration, you end up overspending.

This share of 30% has been given so that you also spend a little on yourself every month, so that your life remains balanced and stress-free. But it does not mean that you cross the limit. If you know that your wants constitute 30% of the budget, then you will make smart choices and avoid impulse buying. Here, self-control and planning are very important. If you spend less in any month, then you should invest that saved money in savings. This way, you remain financially disciplined and also enjoy life without any guilt.

Saving and Debt Repayment (20%):

When the last part of the 50/30/20 rule comes, it is the 20% that most people ignore, but in reality, this is the part that makes your financial life secure. In this 20% you have to include your savings, and if you have any debt, then its repayment. Many people focus only on earning and spending, but do not think about the future. For this reason, when any emergency comes, they do not have money and they get stressed or have to take a loan. If you set aside 20% of your income every month, slowly your emergency fund will grow. From this, you can also make long-term savings like a retirement plan, an education fund, or any big goal like buying your own house.

If you have any loans, it is important to pay them off slowly from this 20% so that the interest does not increase and the burden is reduced. The biggest advantage of saving is that you do not need anyone’s help or take a loan in the future, and you remain financially independent. Never use this 20% for luxuries or wants. Many people make this mistake that when they have extra money, they spend it on shopping or fun, when in reality, that money is meant to secure their future. That is why it is very important to follow this part of the rule.

Conclusion:

The most important thing in the end is that the 50/30/20 rule is actually a simple guide that helps everyone manage their money. Many people think that budgeting is boring work or is only for those who live in the clutches of money, but in reality, budgeting is important for anyone who wants to be secure both today and tomorrow. The 50/30/20 rule is popular because it does not require complicated spreadsheets and formulas. You just have to look at your monthly income and divide it into three parts: 50% for essentials, 30% for wants, and 20% for savings or paying off debts. Everyone’s financial situation is different, so it is not necessary that this percentage is fixed; you can make slight adjustments in it according to your needs.

For example, if your income is low, then you may be spending more than 50% on essentials, but it can be balanced slowly by making a plan. The most important thing is that you maintain discipline and do not break your rules. Review you’re spending every month and see if you are going overboard on your desires. When you follow this simple framework, saving money, paying off debt, and securing your future become very easy. This rule brings peace in life and reduces financial stress, which gives you peace of mind and freedom.

FAQs:

1. What exactly is the 50/30/20 rule, and how does it work?

The 50/30/20 rule is a simple budgeting method where you divide your monthly income into three parts: 50% for essential needs (like rent, bills, groceries), 30% for wants or lifestyle expenses (like dining out, shopping, entertainment), and 20% for savings and debt repayment. This rule helps you manage your money better, avoid overspending, and secure your financial future in an easy, practical way.

2. What expenses should be included in the 50% ‘Needs’ category?

The 50% ‘Needs’ category covers all your necessary living expenses that you cannot avoid. This includes rent or mortgage, utilities like electricity, water, gas, basic groceries, essential transportation, and other bills that are required to live comfortably. Luxury items, upgrades you don’t urgently need, or non-essential subscriptions should not be counted here.

3. How can I tell the difference between ‘Needs’ and ‘Wants’?

A ‘Need’ is something you must pay for to live and work (like rent, utilities, or groceries). A ‘Want’ is something that improves your lifestyle but is not essential for survival — for example, eating at restaurants, vacations, designer clothes, or the latest gadgets. The clearer you are about this difference, the better you’ll stick to the 50/30/20 rule and avoid mixing categories.

4. Why is the 20% savings and debt repayment part so important?

This 20% portion is what builds your financial security. It helps you build an emergency fund, save for big future goals like retirement, your child’s education, or buying a house, and pay off any loans you have, so interest doesn’t keep increasing. Without this part, people often struggle during emergencies or end up in debt traps. So, never skip this step.

5. Can I adjust the percentages in the 50/30/20 rule if my income or expenses are unusual?

Yes! The 50/30/20 rule is a guideline, not a strict law. If your income is lower or your needs are higher (for example, higher rent in your city), you might spend more than 50% on essentials. That’s okay, the goal is to create awareness and slowly adjust your spending habits. The important part is to stick to a clear plan, review your expenses regularly, and always keep some portion for savings and debt repayment.